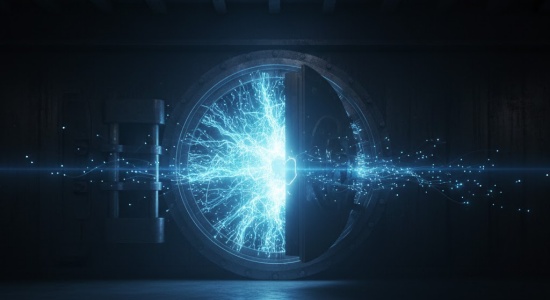

For decades, the banking industry operated on a philosophy of isolation. Financial institutions were “proprietary islands”—closed systems built on legacy mainframes, speaking languages that only their own internal servers could understand. If you were a customer, your data was effectively a “locked box.” Accessing that data or moving it to another service required manual file exports, paper statements, or the risky practice of “screen scraping.”

Today, that wall has cracked. The rise of Open APIs (Application Programming Interfaces) has transitioned banking from a series of disconnected fortresses into a global, interconnected utility. This isn’t just a technical upgrade; it is a fundamental shift in how value and information move across the global economy.

I. From “Screen Scraping” to Structured Connectivity

Before Open Banking became a regulated standard, third-party apps had to rely on a messy process called screen scraping. Users would hand over their bank login credentials to an app, which would then “impersonate” the user, log in, and literally scrape the text off the screen to gather data. It was fragile, slow, and a security nightmare.

Open APIs replaced this chaos with a structured conversation. Instead of an app “sneaking in” through the front door, the bank provides a dedicated “service entrance.”

- Standardized Language: APIs allow two different systems to communicate using a common dialect (usually JSON over HTTPS).

- Predictable Outcomes: When an app asks a bank API for a balance, it receives a clean, structured data packet that can be processed instantly without errors.

- Direct Actions: Beyond just reading data, APIs allow apps to initiate actions, such as automating bank transfer payments or verifying an identity, without the user ever leaving the third-party interface.

II. The Architecture of the “Always-On” Economy

The true power of an API-driven banking system is its persistence. Because APIs operate 24/7/365, the concept of “banking hours” is becoming obsolete at the infrastructure level.

In the old model, banks moved data in “batches”—usually overnight. If you made a transaction on a Friday, it might not show up in your accounting software until Monday. Open APIs enable Real-Time Synchronization. The moment a transaction occurs, a “Webhook” (an automated message sent by an API) can alert your budgeting app, your business ledger, or your tax software. This creates a “Live View” of liquidity that was previously impossible for both individuals and corporations.

III. The Democratization of the Banking Stack

Perhaps the most significant impact of transitioning to a utility model is the lowering of the barrier to entry for innovation. In the proprietary era, launching a financial product required a direct, multi-year partnership with a major bank. You needed deep pockets and even deeper connections.

With Open Banking, the “banking stack” has been democratized.

- The Infrastructure Layer: Banks provide the core ledger and regulatory compliance through APIs.

- The Middleware Layer: Fintechs provide the “pipes” that connect different banks into a single interface.

- The Application Layer: Developers build niche tools for freelancers, gig workers, or international travelers.

This modularity means that a three-person team in a garage can build a world-class financial tool because they no longer have to build the “bank” part—they just connect to the “bank utility” via an API.

The New Financial Standard

The transition from a locked box to a global utility is nearly complete. We are moving toward a world where “banking” is no longer a place you go, but a set of functions that are embedded into every digital interaction. Whether it’s a social media app allowing you to send money to a friend or an ecommerce platform offering instant credit at checkout, the “invisible wires” of Open APIs are the reason it works. By opening the box, the industry hasn’t lost its value; it has found a new way to be essential in a hyper-connected world.