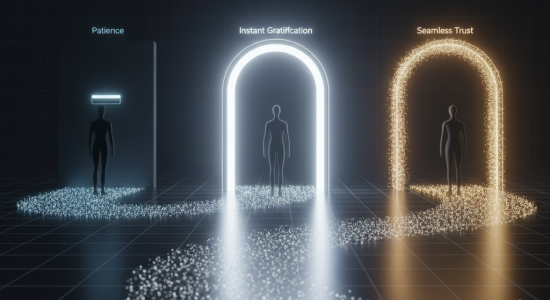

The first few moments a new user spends on your platform are the most fragile of their entire lifecycle. This is the digital first impression, the window where excitement can either blossom into loyalty or wither into abandonment. In the world of fintech, the bank account verification step is often the centerpiece of this critical moment. It’s far more than a security checkpoint; it’s the first chapter of your customer’s story, and the method you choose dictates whether that story is one of friction, satisfaction, or seamless trust.

Viewing this process through the lens of user experience (UX) reveals that you are not just choosing a technology, but designing an emotional journey. Each of the three common methods tells a very different tale.

The Story of Patience: A User’s Journey with Microdeposits

The scene is familiar. A user signs up for your service, excited to get started. They enter their bank account and routing numbers, and then they hit a wall. A message appears: “Great! We’ve sent two small deposits to your account. Please check for them in 1-3 business days and return to enter the amounts.”

This is the user experience of delay. The customer’s forward momentum is brought to a dead halt. Their journey is now fragmented, requiring them to leave your platform, remember to check their bank statement over several days, and then—critically—find the motivation to return and complete the task. Every step added to this process is a potential exit point. For a business, this friction can be fatal to conversion rates. While this method feels safe and non-intrusive to some, it asks the modern user for the one thing they have in short supply: patience. It’s a story that risks ending before it truly begins.

The Story of Instant Gratification: A User’s Journey with Instant Transfers

Now, picture a different user. They’re signing up for a peer-to-peer payment app because they need to pay a friend back for dinner right now. They reach the verification step. A secure, branded pop-up prompts them to log in to their bank. They use their phone’s Face ID, select their account, and in less than a minute, a confirmation message appears: “Success! Your account is connected.”

This is the user experience of immediacy. The journey is fast, linear, and satisfying. The user’s intent is immediately converted into action, reinforcing the value of your service from the very first interaction. This story creates a powerful emotional payoff, associating your brand with speed and efficiency. The only potential plot twist is the trust hurdle; a small segment of users may feel hesitant to enter their bank credentials through a third-party portal. However, for the vast majority of the mobile-first generation, this is the expected standard for a modern, frictionless experience.

The Story of Seamless Trust: A User’s Journey with APIs

Finally, consider a user applying for a loan on a sophisticated fintech platform. As part of the flow, they are asked to connect their bank. They select their bank’s logo and are momentarily redirected to their bank’s own familiar, secure login screen or mobile app. They authorize the connection with a single click, never sharing their password with the fintech platform itself. They are returned to your app, where a message confirms their account is verified and their income has been analyzed.

This is the user experience of invisibility and security. The process is so smooth and integrated that it barely feels like a separate step. The user’s journey is not just fast; it’s deeply reassuring. By leveraging a direct, bank-authorized API connection (often through Open Banking), you are borrowing the trust the user already has in their own financial institution. This story eliminates friction while simultaneously maximizing confidence. It tells the user that your service is modern, secure, and built on a foundation of trust.

Ultimately, the bank verification method you choose is a reflection of the customer experience you aim to provide.

Are you asking your users to wait, providing them with instant results, or offering a journey so seamless it feels like magic?

In a crowded market, the companies that win are those that obsess over these first five seconds and choose to tell a story of effortless trust.